Not known Facts About Paul B Insurance

Wiki Article

More About Paul B Insurance

Table of ContentsPaul B Insurance Can Be Fun For EveryoneThe Single Strategy To Use For Paul B InsuranceThe Greatest Guide To Paul B InsuranceThe Facts About Paul B Insurance UncoveredThe Facts About Paul B Insurance RevealedOur Paul B Insurance PDFs7 Easy Facts About Paul B Insurance Described

The insurance coverage business will review this report very closely when exploring your insurance claim. Take notes that cover all the information of the mishap.

The time the mishap happened. The names as well as contact details of witnesses to the accident. The climate and road problems at the time of the mishap. The name and badge variety of the officer who shows up at the mishap scene. File a claim with your insurer immediately after the accident.

He or she will: Consider and also take photos of the damages to your automobile. Check out the crash scene. Interview you, the various other vehicle driver or vehicle drivers involved, and witnesses to the accident. Evaluation the police record concerning the crash. Examine hospital bills, clinical documents, and also evidence of lost salaries related to the mishap with your permission.

Paul B Insurance Things To Know Before You Get This

Figure out mistake in the crash. Deal a negotiation quantity for your case based on fault and also other factors. Go after the various other chauffeur's insurance policy company if he or she was at mistake. You do not have to wait until this process has actually been finished to fix your lorry and also look for medical treatment as long as you have coverage for those products.Comprehending exactly how automobile insurance works ought to be a concern for any type of new chauffeur. Speak with your insurer if you already have coverage but wish to discover more about your plan. An agent can help you choose vehicle insurance that safeguards your individual properties from loss in an auto crash.

Therefore, term life insurance policy has a tendency to be extra economical than long-term life insurance policy, with a set rate that lasts for the entire term. As the original term attracts to a close, you may have three alternatives for ongoing protection: Allow the plan expire and change it with a new policy Restore the policy for one more term at an adjusted rate Convert your term life insurance coverage to whole life insurance Not all term life insurance policies are sustainable or convertible.

All about Paul B Insurance

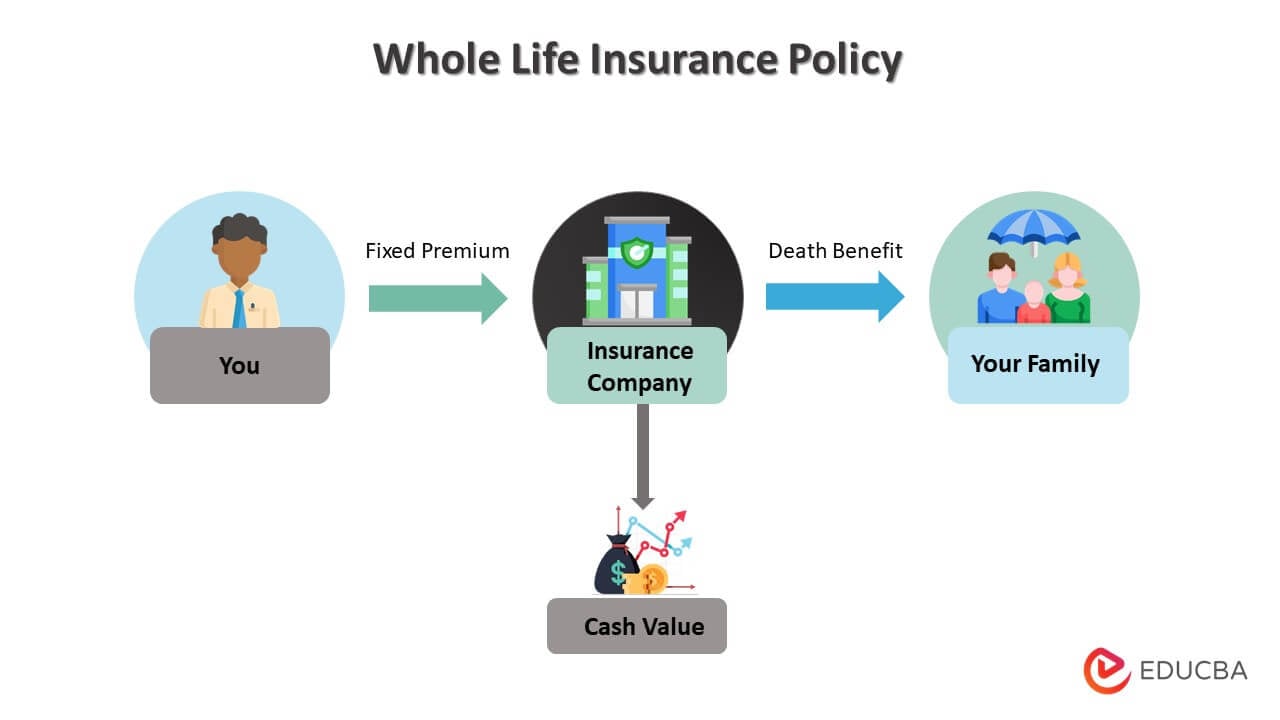

The payout mosts likely to the lender instead than any survivors to settle the continuing to be balance. Because credit scores life insurance policy is so targeted, it is easier to get approved for than other options. As long as the policyholder pays the costs, permanent life insurance never ever expires. Because it covers the insured's whole life, costs are greater than a term life insurance policy.

Check out more concerning the various kinds of long-term life insurance listed below. While the policyholder is still active, he or she can draw on the plan's cash money value.

The 10-Second Trick For Paul B Insurance

The vital difference is the insurance holder's capability to spend the policy's cash worth. Throughout all this, the policyholder needs to maintain a high enough money value to cover any type of plan costs.On the other hand, the earnings from a high-return financial investment can cover some or More hints all of the premium prices. One more advantage is that, unlike with most plans, the cash money worth of a variable plan can be included in the survivor benefit. Last expenditure life insurance coverage, additionally called interment or funeral insurance policy, is meant to cover expenses that will certainly be credited the insurance holder's family members or estate.

It is a particularly appealing alternative if one celebration has health problems that make a specific policy expensive. It is less usual than various other kinds of irreversible life insurance.

The Buzz on Paul B Insurance

A couple of points you need to recognize about travel insurance policy: Benefits differ by strategy. Traveling insurance coverage can not cover every feasible situation.Without travel insurance policy, you would certainly shed the money you invested on your getaway., which means you can click be repaid for your prepaid, nonrefundable journey costs.

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png)

The Best Strategy To Use For Paul B Insurance

You can compare the expenses as well as advantages of each. It consists of journey cancellation, trip disturbance as well as journey delay advantages.

This cost effective strategy consists of emergency medical as well as emergency transportation benefits, as well as various other post-departure advantages, but trip cancellation/interruption. If you want the reassurance of bring considerable traveling insurance advantages, the ideal fit may be the One, Journey Prime Strategy. This plan also covers kids 17 and under free of charge when taking a trip with a moms and dad or grandparent.

It provides you cost effective protection for a full year of travel, including benefits for visit this page trip termination and disturbance; emergency healthcare; lost/stolen or postponed luggage; and also Rental Auto Burglary & Damages security (offered to locals of the majority of states). The finest time to acquire travel insurance is promptly after you have actually finished your traveling arrangements.

Not known Details About Paul B Insurance

Likewise, you need to acquire your strategy within 14 days of making your preliminary journey deposit in order to be qualified for the pre-existing clinical problem advantage (not readily available on all strategies). If you're not entirely satisfied with your plan, you have 15 days (or extra, depending upon your state of home) to request a refund, given you haven't started your trip or initiated a claim.Strategies may use some added benefits that Original Medicare doesn't cover like vision, hearing, and also dental solutions. You join a strategy used by Medicare-approved personal companies that adhere to policies established by Medicare. Each plan can have various policies for exactly how you obtain services, like requiring referrals to see an expert.

Report this wiki page